2021-03-27 白銀是新的黃金嗎?

Is silver the new gold?白銀是新的黃金嗎?

Arkadiusz Sieron Arkadiusz Sieron

Friday March 26, 2021 17:00

Many analysts expect silver to outperform gold this year. It's possible, but investors shouldn't count on improving economic conditions and industrial demand.

許多分析師預計白銀今年將跑贏黃金。有可能,但投資者不應指望改善經濟狀況和工業需求。

Silver has recently become a hot investment theme. For months, if not years, some analysts claimed that silver is undervalued relative to gold. Then, at the beginning of 2021, Reddit revolutionaries tried to trigger a short squeeze in silver. Although that attempt failed, silver has, so far, clearly been outperforming gold this year , as the chart below shows. So, is silver now a better investment than gold?

白銀最近成為熱門的投資主題。數月甚至數年以來,一些分析師聲稱白銀相對於黃金的價值被低估了。然後,在2021年初,Reddit革命者試圖引發短暫的白銀緊縮。如下圖所示,儘管這一嚐試失敗了,但到目前為止,白銀今年迄今為止顯然已經超過了黃金。那麼,白銀現在比黃金更好的投資嗎?

圖一: 2019-2021銀價與金價

*註: 藍線為白銀走勢,黃線為黃金走勢

*註二: X軸為日期,左Y軸為銀價,右Y軸為金價

Well, why would it be? After all, many investors buy silver for the same reasons that they purchase gold – it's a rare, monetary metal which may be used as an inflation hedge , a safe-haven asset against tail risks , or a portfolio diversifier . It's just cheaper than gold – and this is why it's often called the poor man's gold.

好吧,為什麼呢?畢竟,許多投資者以購買黃金的相同理由購買白銀-這是一種稀有的貨幣金屬,可用作通貨膨脹對沖,防範尾部風險的避險資產或投資組合多元化。它只是比黃金便宜-這就是為什麼它經常被稱為窮人的黃金。

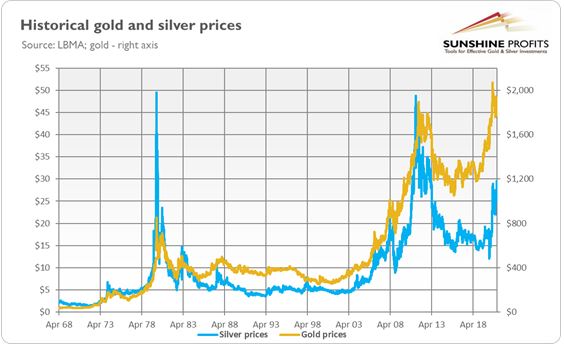

Indeed, silver has a very high positive correlation with gold . Just take a look at the chart below, which illustrates the movement of gold and silver prices since April 1968. The shapes of the lines are very similar and the correlation coefficient is as high as 0.90!

確實,銀與金具有非常高的正相關性。請看下面的圖表,該圖表說明了自1968年4月以來黃金和白銀的價格走勢。線條的形狀非常相似,相關係數高達0.90!

圖二: 歷史銀價與金價

*註: 藍線為白銀走勢,黃線為黃金走勢

*註二: X軸為日期,左Y軸為銀價,右Y軸為金價

On the other hand, silver may indeed outperform gold. After all, silver has a dual nature. It is not only a monetary asset – like gold – but also an industrial commodity. This implies that silver is more business cycle -sensitive than gold. Therefore, given that the global economy is recovering from the deep recession caused by the coronavirus pandemic and the Great Lockdown , silver may outperform gold. In other words, although both gold and silver could benefit from reflation during the recovery, improving economic conditions could support the latter metal more .

另一方面,白銀的確可能勝過黃金。畢竟,銀具有雙重性質。它不僅像黃金一樣是一種貨幣資產,而且還是一種工業商品。這意味著白銀比金更對商業周期敏感。因此,鑑於全球經濟正在從冠狀病毒大流行和“大蕭條”造成的嚴重衰退中恢復,白銀的表現可能好於黃金。換句話說,儘管黃金和白銀在復甦過程中都可以從通貨膨脹中受益,但改善的經濟狀況可以為後者提供更多支持。

Another argument for silver shining brighter than gold in 2021 is the historical pattern according to which silver prices tend to follow gold prices with some lag, just to catch up with them later – often overreacting compared with gold's behavior.

在2021年,白銀比黃金更耀眼的另一個論據是歷史模式,根據這種歷史模式,白銀價格往往會跟隨黃金價格有些滯後,只是後來才趕上它們-與黃金的行為相比往往反應過度。

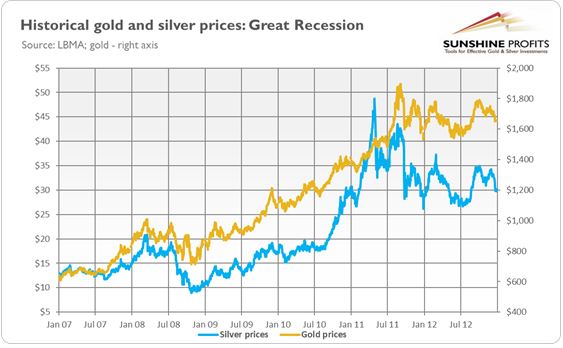

So much for theory. Let's move on to the data now and analyze the previous economic crisis , i.e., the Great Recession , and the following recovery. As the chart below shows, both metals moved generally in tandem, however, silver was more volatile than gold.

理論上非常重要。現在讓我們繼續進行數據分析,分析先前的經濟危機(即大蕭條)和隨後的復甦。如下圖所示,兩種金屬總體上是串聯的,但是銀比金更易揮發。

圖三: 大蕭條時期銀價與金價

*註: 藍線為白銀走勢,黃線為黃金走勢

*註二: X軸為日期,左Y軸為銀價,右Y軸為金價

For example, from its local bottom in mid-2007 to its local peak in early 2008, silver rose 79 percent, while gold "only" 57 percent. Then, in the first phase of the global financial crisis , silver plunged 58 percent (from $20.92 to $8.88), while gold slid 30 percent (from $1011.25 to $712.5). Subsequently, silver skyrocketed 448 percent, reaching a peak of $48.7 in April 2011. Meanwhile, the price of gold reached its peak of $1875 a little bit later, in September 2011, gaining 166 percent. Finally, silver plunged 46 percent by the end of 2011, while gold dropped only 19 percent. This shows that the economic recovery and industrial revival that followed the Great Recession didn't help silver to shine. Actually, the bluish metal underperformed gold .

例如,從2007年中期的局部最低點到2008年初的局部峰值,白銀上漲了79%,而黃金“僅”上漲了57%。然後,在全球金融危機的第一階段,白銀下跌了58%(從20.92美元跌至8.88美元),而黃金下跌了30%(從1011.25美元跌至712.5美元)。隨後,白銀暴漲了448%,在2011年4月達到48.7美元的峰值。與此同時,黃金價格在2011年9月稍稍達到了1875美元的峰值,上漲了166%。最後,到2011年底,白銀下跌了46%,而黃金僅下跌了19%。這表明大蕭條之後的經濟復甦和工業復興並沒有幫助白銀大放異彩。實際上,白色金屬的表現不如黃金。

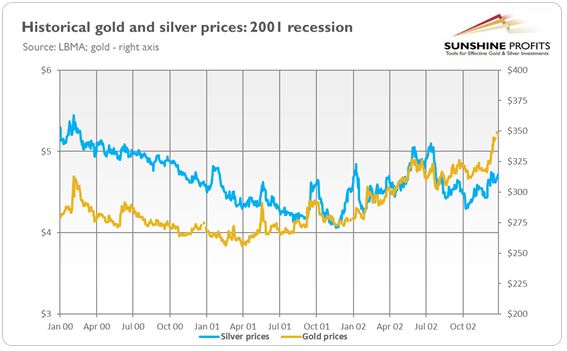

Similarly, silver plunged more than gold (25 versus 17 percent) in the run-up to the burst of the dot-com bubble , as one can see in the chart below. It also gained less than gold in the aftermath of the 2001 recession (25.4 versus 27.5 percent), and then it plunged in the third quarter of 2002, significantly underperforming gold.

同樣,在下圖所示的互聯網泡沫破滅之前,白銀的暴跌幅度比黃金的跌幅更大(分別為25%和17%)。在2001年衰退之後,黃金的漲幅也低於黃金(25.4%對27.5%),然後在2002年第三季度暴跌,白銀的表現明顯落後於黃金。

圖四: 2001年大蕭條時期銀價與金價

*註: 藍線為白銀走勢,黃線為黃金走勢

*註二: X軸為日期,左Y軸為銀價跌幅,右Y軸為金價跌幅

Therefore, the recent history doesn't confirm the view that silver should be outperforming gold in the early stages of a recovery, because it's an industrial commodity that benefits from improving economic conditions. Silver was never in a bullish mode when gold was in a bear market, and it rather tends to rally rapidly in the late stage of the commodity cycle, like in the 2000s.

因此,最近的歷史並不能證實白銀在復甦的初期應該勝過黃金的觀點,因為白銀是一種工業商品,可以從改善的經濟狀況中受益。當黃金進入熊市時,白銀從未處於看漲模式,而是傾向於在商品週期的後期迅速反彈,例如在2000年代。

Actually, one can argue that silver has the best period behind itself. After all, it soared 141 percent from late March to September 2020, while gold rallied "only" 40 percent. So, it might be the case that the catch-up period, in which silver outperforms gold, is already behind us. Indeed, as the chart below shows, the gold-to-silver ratio has recently declined to a more traditional range of 60-70.

實際上,有人可以辯稱,白銀有最好的時機。畢竟,從2020年3月下旬到2020年9月,它飆升了141%,而黃金“僅”上漲了40%。因此,可能情況是白銀跑贏黃金的追趕期已經過去了。確實,如下圖所示,金銀比最近已下降到更傳統的60-70範圍。

圖五: 歷史金銀比

*註: X軸為日期(四月每5年間距),Y軸為黃金/白銀比例

This, of course, doesn't mean that silver cannot rise further. However, it seems that the metal has already caught up somewhat with its more precious cousin . So, it's possible that silver can outperform gold in 2021, as Biden's focus on renewable energy may help silver – as a major part of the metal used in industry is now linked to solar panels and electronics, but history teaches us that investors shouldn't count on industrial demand . Silver didn't outperform gold during recoveries from the previous recessions. Although silver has a dual nature, its price is highly correlated with gold prices. Therefore, macroeconomic factors, such as the U.S. dollar , real interest rates , risk appetite, inflation , public debt , monetary policy , fiscal policy , etc., should have a stronger impact on silver than industrial demand . As always, those entering the silver market should remember that silver price movements are more violent than in the gold market.

當然,這並不意味著白銀不能進一步上漲。但是,金屬似乎已經與其更貴的表弟有所追趕。因此,到2021年,白銀有可能跑贏黃金,因為拜登對可再生能源的關注可能會幫助白銀-因為工業中使用的金屬的主要部分現已與太陽能電池板和電子產品聯繫在一起,但歷史告訴我們,投資者不應依靠工業需求。在上一次衰退中復甦期間,白銀並沒有跑贏黃金。儘管白銀具有雙重性質,但其價格與黃金價格高度相關。因此,諸如美元,實際利率,風險偏好,通貨膨脹,公共債務,貨幣政策,財政政策等宏觀經濟因素對白銀的影響應大於工業需求。與往常一樣,那些進入白銀市場的人應該記住,白銀價格的波動要比黃金市場中的更為劇烈。

By Arkadiusz Sieron

Contributing to kitco.com

Shiny黃金白銀交易所

引用來源: Kitco News

* 以上僅此作者個人觀點,不應做為投資建議。請務必詢問專業資產顧問再投資